By

Director of Climate Science & Impact

Edited: 11 Feb 2026

10 min read

This article relates to current guidance from the Science-Based Targets initiative (SBTi)’s 2024 reports on Beyond Value Chain Mitigation. The upcoming v2 of the SBTi’s Corporate Net-Zero Standard – expected later in 2026 – is likely to include new rules on ‘Ongoing Emissions Responsibility’ (‘OER’) which will provide a new framework that supersedes BVCM. We will provide further guidance to our community when new guidance is published.

As mandatory climate disclosure regulations expand and procurement criteria tighten, sustainability leaders face a strategic imperative: internal decarbonisation alone won't deliver the competitive advantage or meet the compliance standards required in the next phase of climate transition planning.

That’s because in 2026, climate leadership means more than just cutting your own emissions. Ecologi’s three Rs framework of climate leadership - Reduce, Restore and Report - include a core component which requires your business to contribute to restoring our planet, alongside reducing your business’s emissions directly.

What is Beyond Value Chain Mitigation (BVCM)?

Beyond Value Chain Mitigation (BVCM) refers to climate action a business takes outside its own operations and supply chain to accelerate global climate mitigation and adaptation.

Endorsed by the Science Based Targets initiative (SBTi), BVCM includes funding high-integrity carbon avoidance and removal projects, nature restoration, and other climate solutions beyond a company’s value chain.

BVCM does not replace emissions reductions. It complements internal decarbonisation by enabling businesses to contribute to global climate goals while they reduce their own emissions.

Beyond Value Chain Mitigation (BVCM) enables sustainability leaders to transform climate action from a cost centre into a competitive advantage, leveraging climate finance from the private sector to deliver transformative impacts for climate mitigation and adaptation which go beyond businesses’ own operations and supply chains. BVCM is a core part of any credible net-zero strategy, and is endorsed by the Science Based Targets initiative (SBTi) and Oxford Net Zero.

Business benefits of Beyond Value Chain Mitigation (BVCM)

As well as being the right thing to do to accelerate climate action, BVCM matters for your business because the climate crisis presents multiple business risks - so having a robust BVCM strategy is an appropriate corporate strategy.

Climate and financial risk

Disruption from climate change, biodiversity loss, and ecosystem collapse increasingly affects your supply chains, customers, insurance costs, and investment risk (TCFD, 2017; McKinsey, 2020). It’s in your interest to prevent as much of this disruption as possible – because it is material to your business.

Investor and regulator expectations

Investors, regulators, and industry standards bodies like the Science Based Targets initiative are raising the bar on what counts as credible climate leadership, including the funding of climate projects outside the value chain (Axelsson et al, 2024; SBTi, 2024). BVCM is now a core expectation for alignment with net-zero - it is not just a ‘nice-to-have’, and the upcoming v2 of the SBTi’s Corporate Net-Zero Standard is likely to bake BVCM-style requirements into the Standard as well.

Avoiding greenwashing with credible climate action

Employees, consumers, and clients are looking for companies that go beyond legacy offsetting, and demonstrate real impacts, for people and planet (Deloitte, 2024). Historically, criticism of low-impact offsetting strategies has been prompted by businesses exploiting extremely cheap, low-quality voluntary carbon credits - but this corner-cutting only produces greater risk: of being called out for greenwashing, or being fined for misleading claims. You can demonstrate leadership to your stakeholders by building a BVCM strategy that is credible, transparent, and science-aligned.

Competitive advantage through high-integrity BVCM

Businesses that lead in climate action build stronger reputations, win customer trust, attract top talent, and stay ahead of regulation and market shifts (UN Global Compact, 2023; Deloitte, 2024). The vast majority of business leaders already agree that delivering on sustainability goals is critical to future business success, and many are leading by example: the SBTi has now validated science-based targets for over 10,000 businesses. If you can be among the first to demonstrate a credible BVCM approach, you’ll demonstrate differentiation as your competitors scramble to meet evolving standards in the coming years - a hugely valuable tool when your sales team wants your help winning that next RFP. A high-integrity BVCM strategy positions your business as a preferred partner for ESG-focused clients and investors.

It’s likely to become a direct requirement of certified net-zero strategies

Whether it’s through the UK government’s approach to requiring greenhouse gas removals (‘GGRs’) in climate transition plans, or the SBTi’s v2.0 of their Corporate Net-Zero Standard, there’s only one direction of travel for BVCM: what is today’s best practice will be tomorrow’s minimum standard. You need to get ahead of the curve before these new industry and regulatory requirements come into effect.

All this means that when it comes to BVCM, your business can afford no half-measures. But where should you start?

How much should businesses invest in BVCM?

In practice, most credible BVCM strategies involve:

Setting a science-based internal carbon price

Applying it to some or all of a company’s emissions

Allocating the resulting budget across BVCM Goals #1 and #2

As a term, BVCM refers to the climate action a business takes outside its value chain - in other words, outside its direct operations and supplier network. It requires funding projects ‘out there in the world’ which avoid or remove emissions, or otherwise accelerate the global transition to net-zero. This can be through buying and retiring carbon credits, providing investment into early-stage climate projects, or philanthropy.

The first question we often get asked is: how much should I be funding? Helpfully, the SBTi provides guidance on this, suggesting setting a science-based carbon price (SbCP) which will establish each year’s BVCM budget.

There are a number of different ways to approach this, but some are more credible than others. We’ll publish a longer write-up on how to set a science-based carbon price later this year, but for now, suffice it to say that a minimum credible science-based carbon price is likely to be in the region of £20-60 per tonne.

The two main goals of Beyond Value Chain Mitigation (BVCM)

As described by the SBTi in their Above and Beyond report, published in 2024, BVCM has two objectives:

Goal #1 – Deliver additional near-term mitigation outcomes

Deliver additional near-term mitigation outcomes to achieve the peaking of global emissions in the mid-2020s and the halving of global emissions by 2030.

Goal #2 – Drive finance into scaling climate solutions

Drive additional finance into the scale-up of nascent climate solutions and enabling activities to unlock the systemic transformation needed to achieve net-zero by mid-century globally.

Underpinning these Goals are four BVCM Principles: scale (maximising climate mitigation outcomes), financing need (placing a focus on underfunded projects), co-benefits (supporting the UN Sustainable Development Goals) and climate justice (addressing inequalities).

As well as the commercial benefit of designing and disclosing a robust BVCM strategy, the Goals and Principles also provide a guide for businesses, to seize the opportunity to participate in producing a meaningful impact for our climate, nature and people.

How to build a Beyond Value Chain Mitigation (BVCM) strategy

There are three main approaches to undertaking BVCM - each with their own benefits and limitations - which are: tonne-for-tonne, money-for-tonne and money-for-money (SBTi, 2024).

There’s no ‘one size fits all’ approach you can take - which approach is right for your business will depend on your business model, industry, size and priorities.

Based on Company A producing 1,000 tCO2e of emissions in the reporting period…

Approach | Description | Ease of implementation How easy is this approach to deliver in practice? | Impact and credibility How likely is this approach to produce meaningful impact, and be credible to stakeholders? | Contribution and Cost How much is this approach likely to cost Company A? | Compliance readiness How likely is this approach to be compliant with best practice or standards? | Example |

|---|---|---|---|---|---|---|

Tonne-for-tonne | Match your emissions with an equivalent number of verified carbon credits. | High | Low-to-medium | Low | Low | Company A buys and retires 1,000 high-quality carbon credits. |

Money-for-tonne | Fund BVCM based on a set price per tonne of emissions you produce. | Medium | Medium-to-high (depends on the carbon price selected) | Medium-to-high (depends on the carbon price selected) | High | Company A sets an internal carbon price of £50/tCO₂e (producing a budget of £50,000) and allocates that spend across different kinds of BVCM projects. |

Money-for-money | Dedicate a fixed percentage of revenue (or profits) toward climate action. | Low | Medium-to-high (depends on the total sum disbursed) | Medium-to-very high (depends on the percentage selected) | High | Company A commits 2% of its annual profits to fund BVCM projects. |

In reality, some form of hybrid approach which combines elements of multiple of these is likely to be most impactful. In their Above and Beyond report, the SBTi suggests a particular hybrid model which establishes an overall BVCM budget using a money-for-tonne approach, but also contains a tonne-for-tonne element as well.

At Ecologi, we can help you identify and implement the right strategy for your business, and help you to set a science-based carbon price.

Best practice for BVCM Goal #1: Aligning with the Oxford Principles

What it means

In order to meet BVCM Goal #1, businesses should fund "additional near-term mitigation outcomes" to accelerate global climate action (SBTi, 2024). This is going to be the first thing you spend money on, from your overall BVCM budget. How much of your budget you use on this step is going to be based on how you approach Goal #1 as a whole.

The example provided in the SBTi’s report indicates that Goal #1 efforts should include ‘quantified mitigation outcomes’ (verified and measured in tCO2e) covering at least 50% of the company’s emissions. This is describing a tonne-for-tonne approach. But there are better and worse ways to deliver a tonne-for-tonne approach.

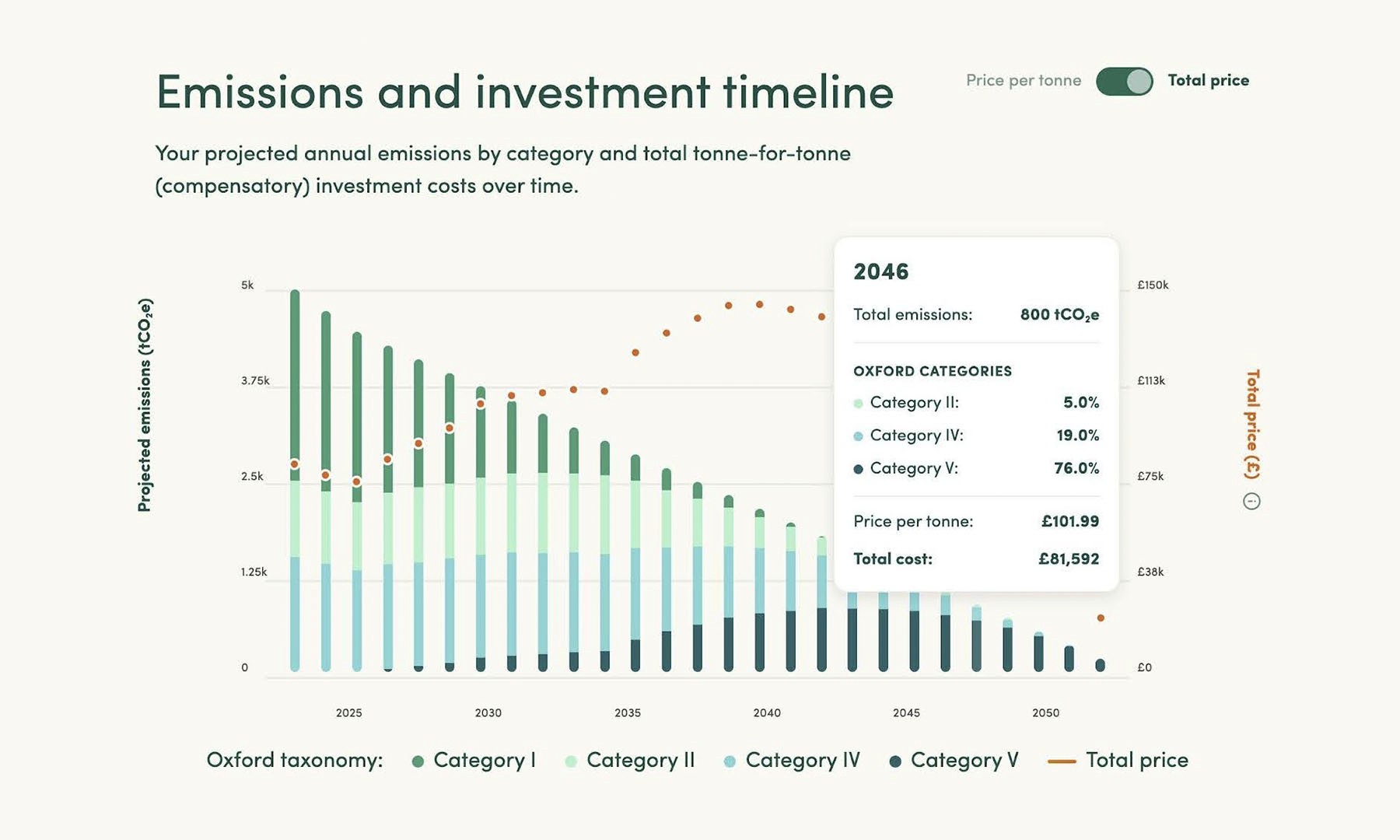

Originally published in 2020, and revised in April 2024, the Oxford Principles for Net-Zero Aligned Carbon Offsetting set the benchmark for any tonne-for-tonne funding activity. Crucially, the Oxford Principles explain how a tonne-for-tonne portfolio ought to evolve over time: to facilitate a transition to a greater proportion of carbon removal in the portfolio, and a higher permanence of the storage of carbon from that carbon removal, as we approach 2050.

The four Oxford Principles themselves are (adapted from Axelsson et al, 2024):

Cut emissions, ensure the environmental integrity of credits used to achieve net-zero, and regularly revise your offsetting strategy as best practice evolves.

Transition to carbon removal offsetting for any residual emissions by the global net-zero target date (2050 at the latest).

Shift to removals with durable storage (low risk of reversal) to compensate for any residual emissions by the net-zero target date (2050 at the latest).

Support the development of innovative and integrated approaches to achieving net-zero.

Why it’s important

Including a high-integrity approach to BVCM Goal #1 (the tonne-for-tonne component) which aligns with the Oxford Principles is crucial to your business for several reasons:

Improve operational efficiency:

Streamlined procurement through selecting ICVCM-Eligible carbon standards reduces overheads associated with project due diligence, whilst ensuring compliance with best practice.

Adhering to transparency requirements such as the use of public registries and disclosures of credits retired supports transparent stakeholder communication, and reduces risks of accusations of greenwashing.

Reduce financial exposure:

Long term business planning between your CSO and CFO and leveraging early-stage investments into carbon markets will hedge against widely-anticipated future cost inflation in the carbon markets.

UK VAT implications from September 2024 require CFO-level budget planning and may impact cost-per-tonne calculations for your multi-year commitments: so a strategically designed BVCM portfolio is going to be crucial to medium and long term corporate planning.

Risk mitigation:

Establishing a diversified BVCM portfolio - across both project types and suppliers - reduces single-project failure risk which could impact credibility and your ability to achieve your ESG targets.

Adherence to credible third-party best practice and verification standards provides liability protection in an ever-evolving regulatory landscape.

How to do it

Remember, BVCM Goal #1 focuses on the tonne-for-tonne part of your portfolio.

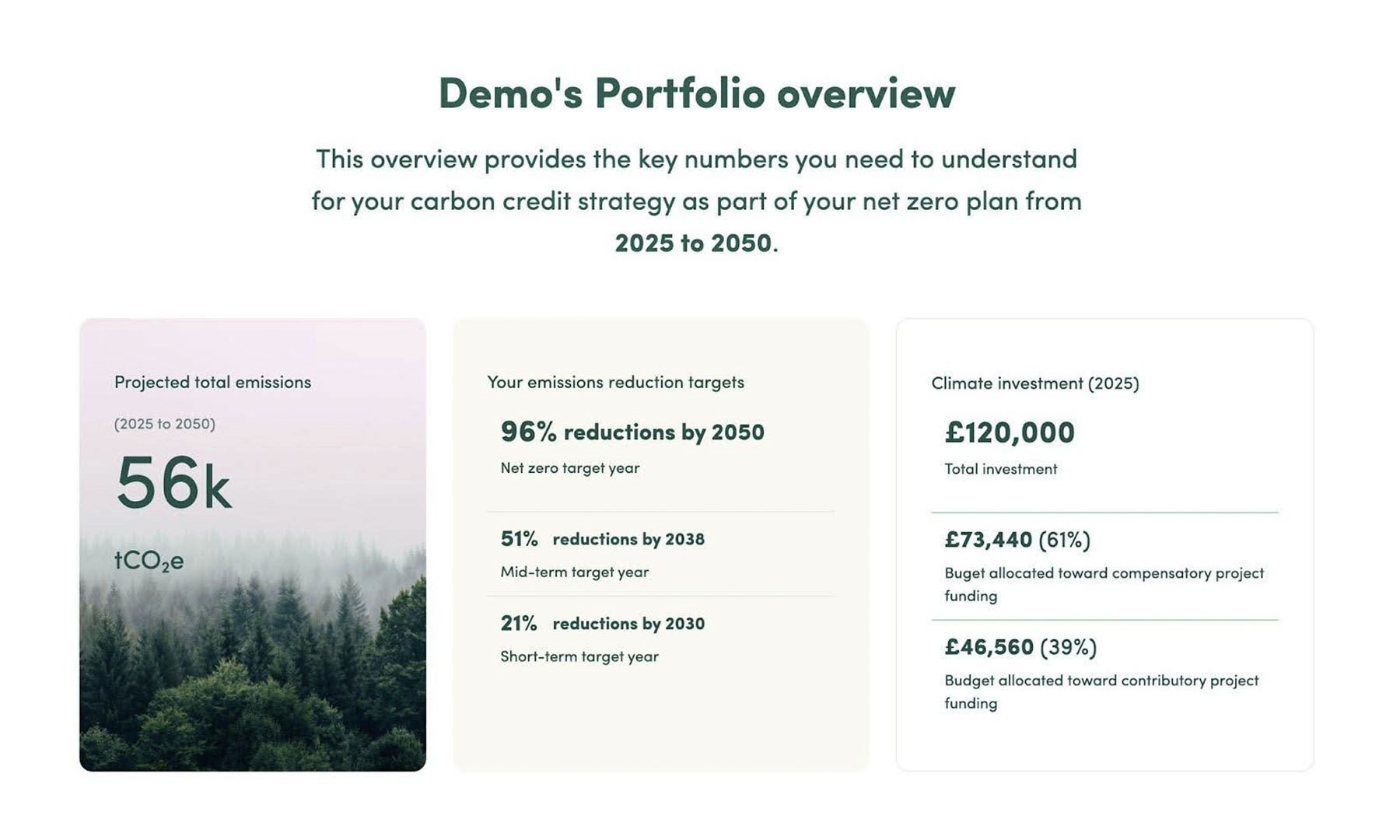

Decide what percentage of your emissions inventory to match using carbon credits. SBTi recommends at least 50%, but you can adjust this based on your goals. Ecologi specialists can help you map out an Oxford Principles-aligned portfolio and estimate rough cost projections.It might look something like this:

To meet this requirement:

Buy and retire credits on the voluntary carbon market (these should be verified to a reputable, ICVCM-Eligible carbon standard like Gold Standard, Verified Carbon Standard, Puro Standard, Isometric, etc.).

Ensure credits are retired publicly in your company’s name if you intend to make any green claims against them (without greenwashing).

Consider that from 1st September 2024, UK carbon credit purchases may be subject to VAT.

Remember that carbon credit quality is vital

Do not buy just any old carbon credits you can find on the voluntary market. Whilst all carbon credits are ostensibly ‘the same’, there is a lot of variation in quality from one project to the next (SBTi, 2024; Axelsson et al, 2024), and there are a lot of poor quality credits still available for purchase on the market. In fact, within the first Oxford Principle is the specific directive to “ensure the environmental integrity of credits used”.

Buying cheap, low quality carbon credits is not enough, and it is a very high risk strategy for your business - and it’s also unlikely to produce any meaningful impact out in the world - which after all, is what BVCM is intended for. Despite this, the vast majority of organisations retailing carbon credits do not underwrite the quality of those credits, so seek out and work with providers who perform extensive due diligence.

At Ecologi, we take great pride in the work our team carries out to assess the quality and integrity of the projects we fund. During 2024, we developed our proprietary Carbon Projects Assessment Framework - and published a whitepaper on it in early 2025.

The Framework leverages our extensive in-house carbon markets expertise and synthesises it with Ecologi’s deep relationships with all four of the leading carbon credit ratings agencies - BeZero Carbon, Calyx Global, Renoster and Sylvera - as well as market intelligence from AlliedOffsets, geospatial analysis through Earth Blox and national-level risk indices.

No carbon credit investment strategy comes without risk, but through Ecologi’s process, we work extremely hard to minimise and mitigate the risks for your business - so that as you build the tonne-for-tonne component of your portfolio to achieve BVCM Goal #1, you can be confident that you’re on the right track and the planet - and your business - will reap the rewards.

More guidance:

Book a call with one of our experts

See how Public Digital built their net-zero strategy and aligned it with the Oxford Principles, below.

BVCM Goal 1 Case Study: How Public Digital is building a credible net-zero strategy with Oxford Principles-aligned carbon offsetting

Their Approach

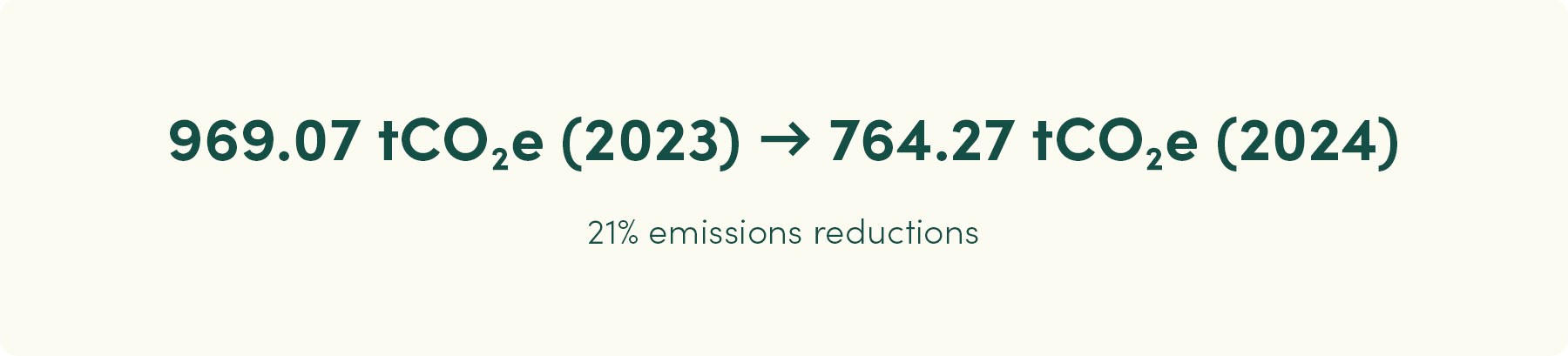

Public Digital has been measuring and reducing its carbon footprint for several years. In 2024, they achieved a 21% reduction - from 969.07 tCO₂e (2023) to 764.27 tCO₂e (2024). For residual emissions, they partnered with Ecologi to align their offsetting strategy with the Oxford Principles for Net Zero Aligned Carbon Offsetting.

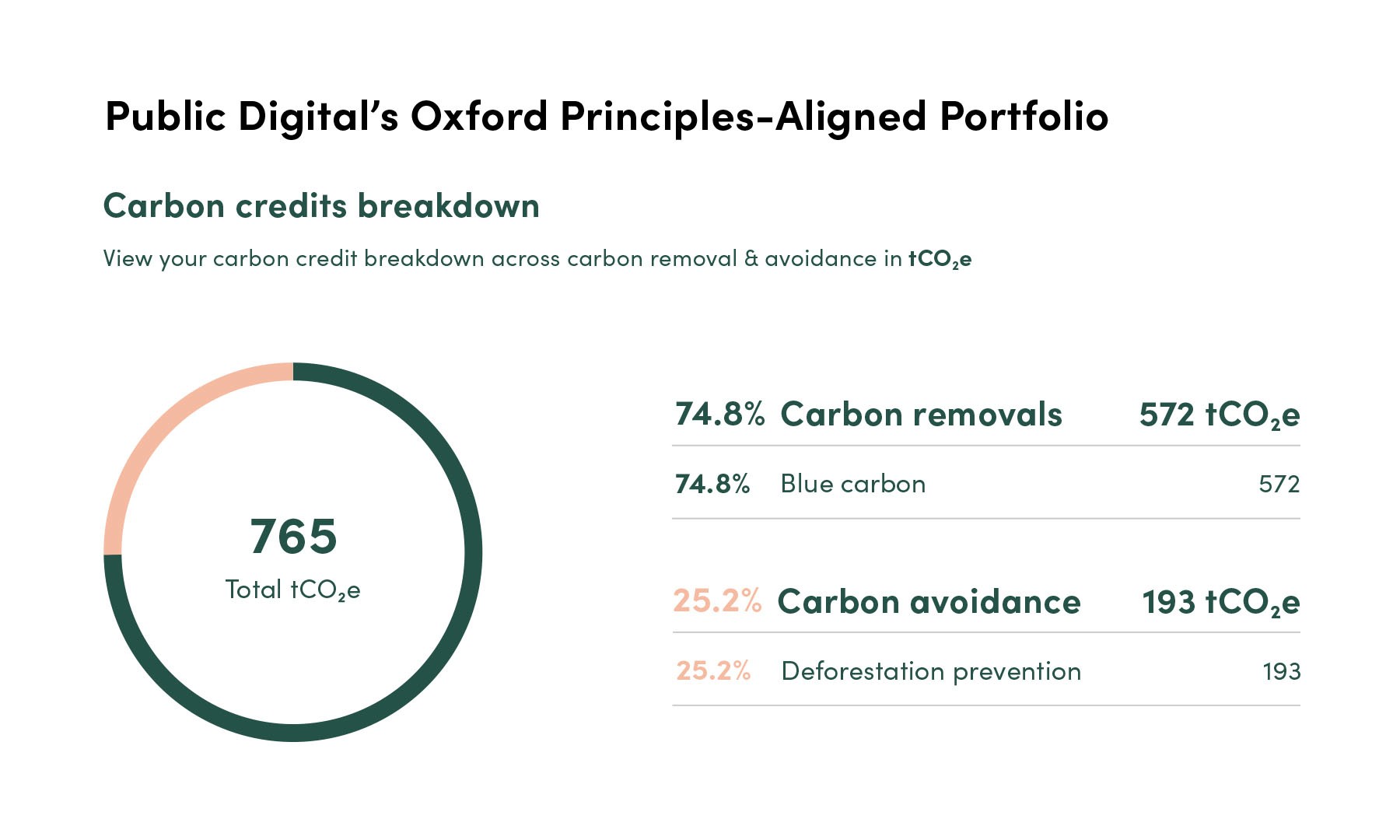

The Strategy

The Oxford Principles recommend a blended portfolio that shifts toward carbon removal over time. Public Digital's 75/25 split demonstrates an advanced, forward-looking approach. As they continue reducing their overall footprint, they plan to progressively increase the proportion of removal credits in their portfolio.

Why It Matters

This demonstrates how companies can responsibly manage residual emissions while contributing to the development of the carbon removal market - balancing immediate climate impact with long-term net-zero requirements.

Best practice for Goal #2: Contributing through Impact Funds

What it means

BVCM Goal #2 encourages businesses to "drive additional finance into the scale-up of nascent climate solutions and enabling activities to unlock the systemic transformation needed to achieve net-zero by mid-century globally." This means that Goal #2 activities go beyond compensating for emissions and are instead contributing to broader global climate action.

This contribution goal means that the impact of Goal #2 funding does not always have to be easily-quantifiable in tCO2e - so the range of available projects is much wider than just things you can measure in carbon credits. But these extra solutions are vital for scaling carbon removal, holistically restoring ecosystems, and supporting community adaptation as our climate changes.

For example, Goal #2 funding could be used for:

Philanthropic nature-based restoration projects

Investment in early-stage carbon removal technologies

Biodiversity and rewilding projects

Climate adaptation programmes for vulnerable communities

Climate policy advocacy or environmental legal defence

And many other things!

For Goal #2, you don’t have to report on tonnes avoided or removed - instead, it’s sufficient to report the financial contributions you made, and the anticipated outcomes that those projects will have.

Why it’s important

Developing a high-integrity approach to BVCM Goal #2 is crucial to your business for several reasons:

Strategic value:

Goal #2 investments position companies as innovation leaders, attracting ESG-focused talent and investors while building future-ready capabilities.

Biodiversity and adaptation funding addresses emerging regulatory requirements (such as TNFD) ahead of competitors, as well as directly playing a part in private sector contributions to plugging the mitigation finance gap.

Portfolio resilience:

Strong Goal #2 portfolios diversify funding across a wide range of different types of philanthropic and non-market-based projects which contribute to global mitigation and adaptation efforts - unlike carbon credits, these diverse projects and funding mechanisms present less opportunity for project ‘underperformance’.

Nature-based solutions in particular deliver extensive co-benefits (for biodiversity, water, soil health and communities) that support multiple ESG objectives per contribution.

Competitive advantage:

Being an early mover in high-quality BVCM portfolios creates sustainable differentiation - as your competitors scramble to meet 2030 targets.

How to do it

How much you have to spend on Goal #2 will depend on what remains of your BVCM budget, after you have tackled Goal #1 in the previous step. Whilst taking the steps in this order will help you work out the financials, Goal #2 is a key phase in your BVCM implementation strategy and is not ‘secondary’ to Goal #1.

The most impactful way to spend your Goal #2 allowance is on holistic projects which are not just driving towards global climate change mitigation - but are also supporting nature restoration and uplifting people as well. That’s why at Ecologi we assess all our projects on the basis of their benefits toward Climate, Nature and People - not just climate alone.

We offer our own set of carefully-curated Impact Funds that distribute funding across a mix of projects. These are outcome-focused rather than input-driven - shifting away from simplistic metrics like "trees planted", because when it comes to climate action, tree planting isn’t the whole story. Our Impact Funds include global Forest & Landscapes Restoration, and our UK Climate and Nature Fund, which contains different kinds of projects based here in the UK.

Our Impact Funds also reduce risk for your business: by spreading funding across a cohort of projects, it also means you are spreading risk. If ever an individual project in the mix were to underperform, your funding to the mix as a whole would still be producing impact across the whole mix.

BVCM Goal 2 Case Study: How giffgaff & MG OMD integrate nature recovery into their advertising & media ecosystem.

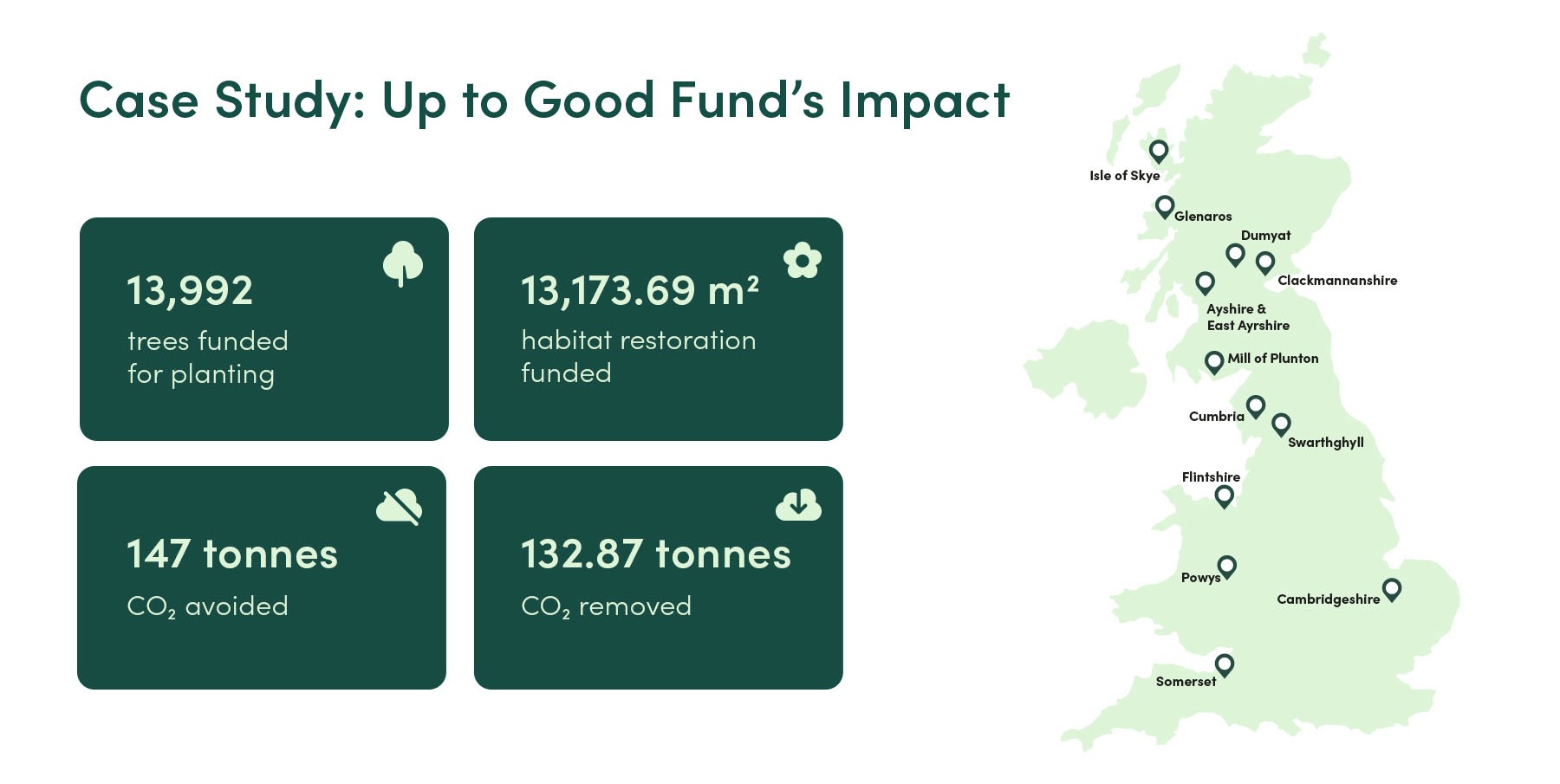

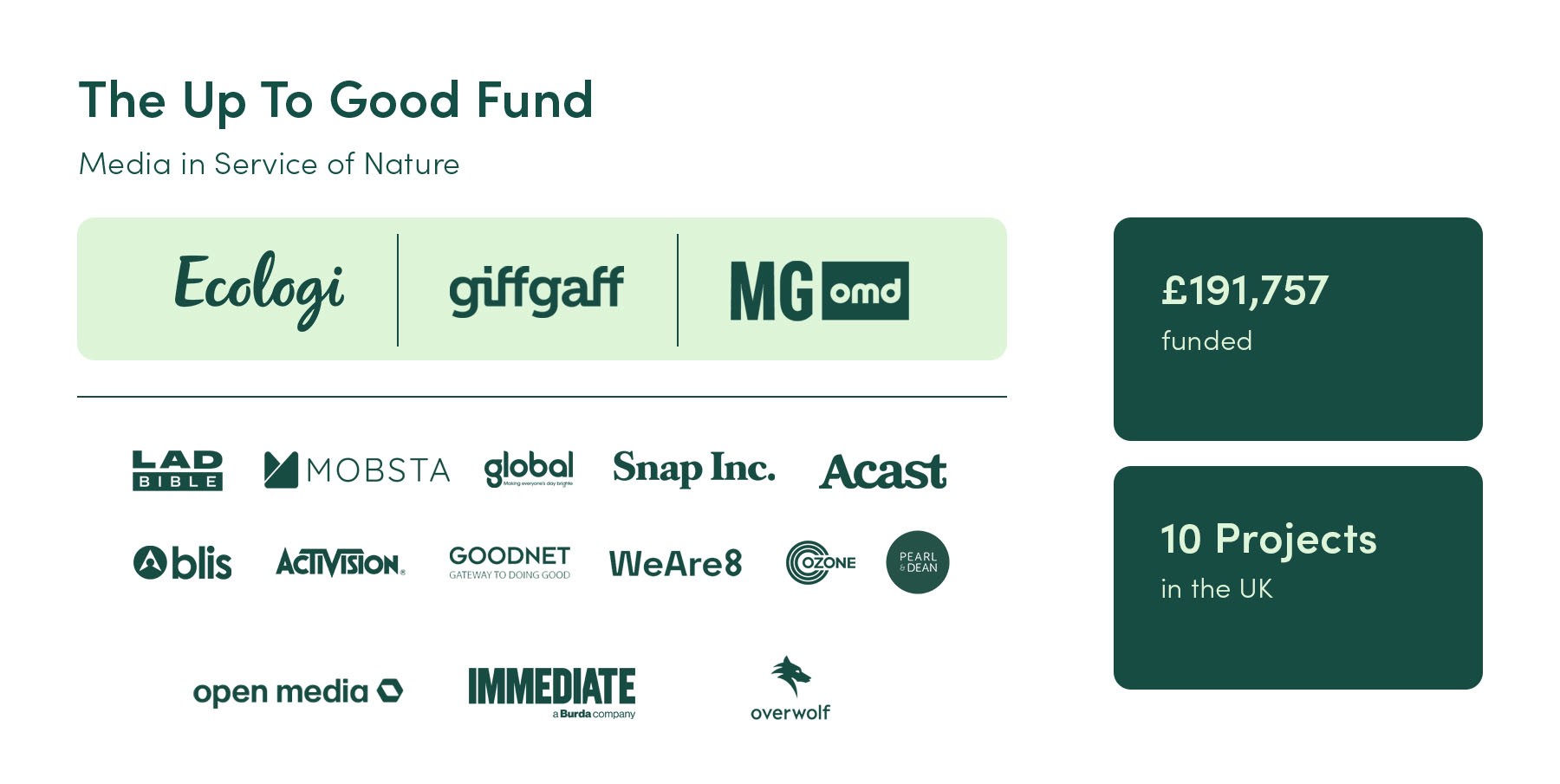

In late 2023, giffgaff and MG OMD established the Up To Good Fund, a pioneering new mechanism to embed UK nature recovery into their media campaigns. Since its inception, 11 media owners have joined the Fund, proving that UK nature recovery can sit alongside campaign performance. Endorsed by Ad Net Zero, the fund provides a blueprint for more brands, agencies & media owners to collaboratively fund high impact UK climate and nature projects, supporting recovery at scale. See their full case study here.

What comes next?

Let’s go back to Ecologi’s three Rs of climate leadership - Reduce, Restore and Report.

By this point, you have measured and disclosed your emissions and set reduction targets (Reduce), and you have designed your BVCM strategy and funded both Goals #1 and #2 (Restore). What remains is to Report - to disclose your activities transparently and communicate them with care in any public-facing green claims you’d like to make.

You’ll have to transparently report your sustainability strategy continually to align with the Greenhouse Gas Protocol and any other certification schemes such as the SBTi’s Corporate Net-Zero Standard - so the Report step will become a regular drumbeat in your calendar. As we have seen, this is what your customers, industry certifications, and investors will need to see (TCFD, 2017; Deloitte, 2024).

But at the same time, the louder version of reporting is advocacy. You can use your reporting and disclosures to signal how you as a business are being proactive in taking accountability for your emissions, and contributing to the restoration of our planet.

Reporting is where credibility is earned or lost and where many businesses face the greatest risk of greenwashing if claims are not carefully framed.

Climate leadership does not wait for regulation

Beyond Value Chain Mitigation is becoming a core expectation of credible net-zero strategies. With updates to the SBTi Corporate Net-Zero Standard expected in 2026, businesses that act early will be better positioned to align with evolving guidance and maintain stakeholder confidence.

Securing access to high-integrity avoidance and carbon removal projects now also strengthens long-term planning, supports budget certainty, and protects the credibility of your Restore strategy as you reduce emissions.

Book a free 30-minute portfolio assessment with one of our climate experts to:

Review your current BVCM and Restore approach

Assess alignment with emerging SBTi and Oxford Principles guidance

Model a science-based carbon price and Climate Action budget

Identify the right balance between compensation and contribution beyond your value chain

References

Axelsson, K., Wagner, A., Johnstone, I., Allen, M., Caldecott, B., Eyre, N., Fankhauser, S., Hale, T., Hepburn, C., Hickey, C., Khosla, R., Lezak, S., Mitchell-Larson, E., Malhi, Y., Seddon, N., Smith, A. & Smith, S.M. (2024). Oxford Principles for Net Zero Aligned Carbon Offsetting (Revised 2024). Oxford: Smith School of Enterprise and the Environment, University of Oxford

Deloitte (2024). The Sustainable Consumer: Understanding consumer attitudes to sustainability and sustainable behaviours. Available here.

McKinsey (2020). Climate risk and response: Physical hazards and socioeconomic impacts. Available here.

SBTi (2024). Above and Beyond: An SBTi report on the design and implementation of Beyond Value Chain Mitigation (BVCM). Version 1.0. Available here.

TCFD (2017). Final Report: Recommendations of the Task Force on Climate-related Financial Disclosures. Available: https://www.fsb-tcfd.org/publications

UN Global Compact (2023). Reimagining the agenda: Unlocking the global pathways to resilience, growth and sustainability for 2030. 12th UN Global Compact-Accenture CEO Study. Available here.