By

Director of Climate Science & Impact

Buying high-quality carbon credits provides vital funding to impactful projects that prevent and remove emissions. However, it’s vital to look at the bigger picture: how carbon credits are being used is critical in taking meaningful climate action for our planet.

Using carbon credits to claim 'carbon neutrality' without reducing emissions at source doesn’t add up - and it certainly won’t solve climate change. Businesses are increasingly under pressure to move beyond this approach, especially with new scrutiny around green claims and offsetting practices.

To take credible climate action, we need to rethink offsetting. We explore how to buy and use carbon credits effectively in our voluntary carbon market guide, but in this article, we’re going back to first principles.

Offsetting to compensate for business-as-usual emissions is out

Science is clear: limiting global warming means cutting emissions significantly and quickly. The IPCC calls for a 50% reduction in carbon dioxide emissions by 2030 and global net-zero by 2050 to give us the best chance of keeping warming below 2°C, and ideally closer to 1.5°C. The longer we wait and continue producing emissions, the harder that path becomes.

Traditional offsetting involves buying carbon credits to balance out emissions. For example, funding a forest protection project to ‘cancel out’ emissions from your operations. Each credit represents one tonne of CO₂ equivalent reduced, avoided or removed elsewhere. But used in isolation, this carbon offsetting strategy can give businesses the impression that it’s okay to continue with high emissions, as long as they pay to offset them.

Even if you’re funding high-quality carbon credit projects, your direct emissions are still entering the atmosphere. That’s true even with carbon removal credits, because removing a tonne of CO₂ after it's emitted doesn’t have the same climate impact as avoiding the emissions altogether. This approach also represents abdicating responsibility for the emissions your business is producing - implying that you’ve done the right thing just because you’ve paid somebody else to reduce theirs.

In short, this offsetting approach is no longer a credible carbon offsetting strategy for businesses. It’s time for a fundamental shift in how businesses think about carbon offsetting.

Reducing emissions while funding high-quality climate action is in

To align your business with climate science, reducing emissions directly across your operations and supply chain is essential. Carbon credits alone won’t deliver net-zero; that requires real reductions first.

That said, funding high-quality carbon projects still plays an important role in global climate action. The Science Based Targets Initiative (SBTi) describes this kind of climate funding (known as Beyond Value Chain Mitigation) as an essential part of reaching global net-zero.

Supporting verified carbon avoidance projects can be a practical and immediate way to start making an impact, especially while you develop your internal emissions reduction plans. These projects mustn’t replace action within your business, but they can complement your efforts and help drive climate finance to where it’s needed most.

Want a clearer picture of how to use carbon credits alongside your emissions strategy?

Want a clearer picture of how to use carbon credits alongside your emissions strategy?

Read our guide to best practice in the voluntary carbon market and explore our Carbon Project Assessment Framework for how we choose the credits we fund.

Reducing your business emissions is a marathon, not a sprint

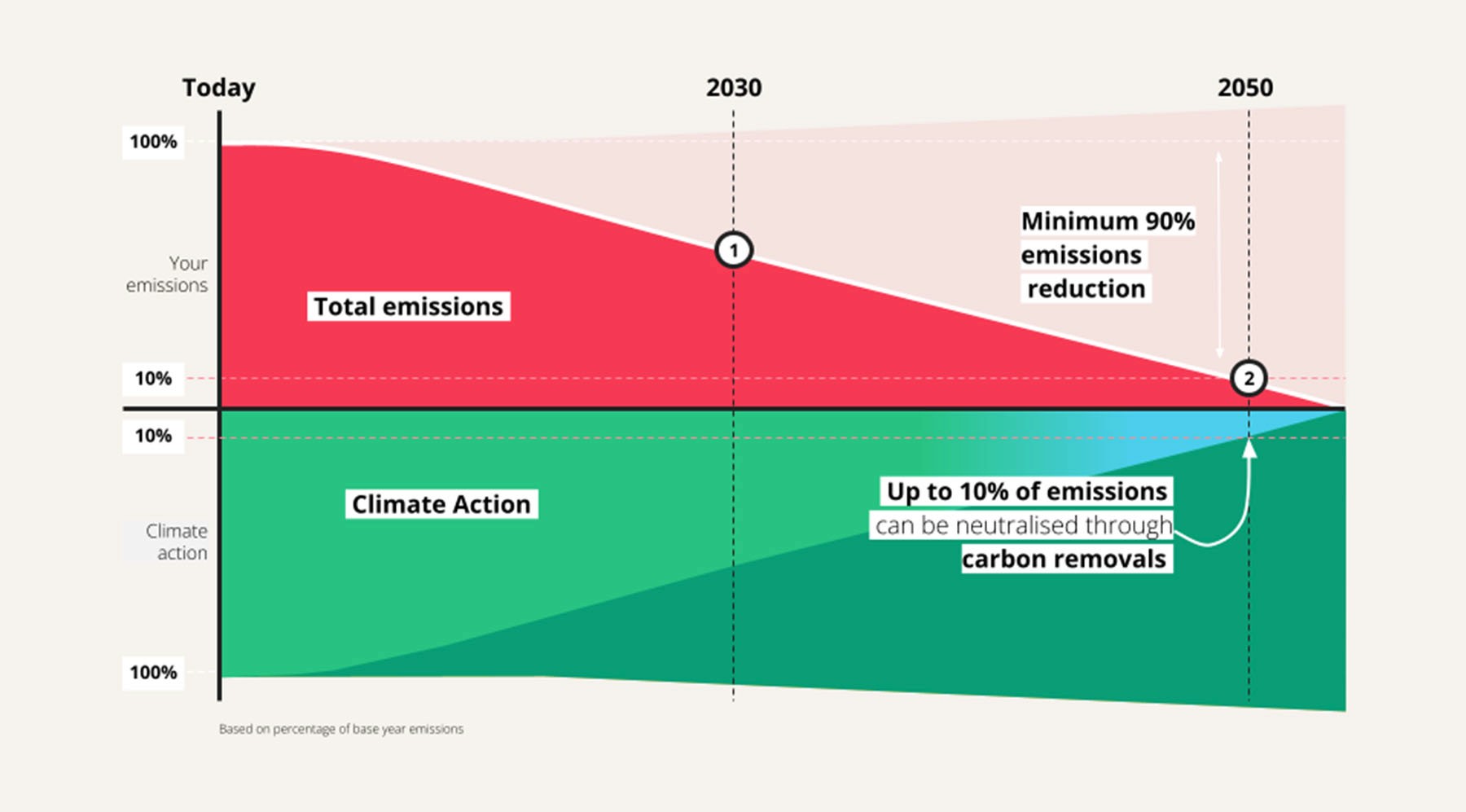

The path to net-zero isn’t short or easy. According to the SBTi, most sectors will need to reduce emissions by at least 90% to align with global climate goals. That’s a huge undertaking, and it won’t happen overnight.

Think of it like trying to cut your business budget by 90%. You’d need to plan carefully, gather the right data, and make steady changes over time. The same applies to emissions.

That’s why setting near-term targets is so important. When the SBTi modelled a net-zero pathway in 2021, it showed that businesses could get there by reducing emissions by just 4.2% each year. That’s still ambitious, but far more manageable than trying to do it all at once. It’s a bit like eating an elephant - you have to take it one bite at a time. (We don’t eat elephants at Ecologi, of course…)

Why fund climate action alongside reductions?

Emissions reduction is a long game. But the climate crisis is already here, and the world can’t wait for every business to complete its internal decarbonisation strategy before funding climate solutions.

That’s why climate action through carbon credits is so important. It’s a way to contribute now - not instead of reducing emissions, but alongside it.

By supporting high-quality carbon offset programs, your business can make an immediate impact on people, nature, and the climate. Projects might restore forests, protect biodiversity, or support communities in developing clean energy access.

Think of it as giving back while you move forward. You can make a difference while your reduction plans ramp up. In fact, that’s exactly how climate funding should work - as part of a joined-up strategy, not a shortcut. And remember: if your business is buying carbon credits for offsetting, the higher your emissions, the more expensive that becomes. Reducing emissions makes financial sense, too.

Beyond value chain mitigation (BVCM) explained

Funding climate solutions outside your own operations is known as beyond value chain mitigation (BVCM). The Science Based Targets initiative (SBTi) describes BVCM as a vital part of the global net-zero journey, because while your emissions cuts are underway, the planet still needs urgent action.

This approach allows your business to support projects with real impact in geographies and communities that align with your values. You might choose to protect tropical forests, expand access to clean cooking technologies, or fund renewable energy where it’s most needed.

Put simply, BVCM means funding high-quality carbon credits as a complement to your emissions reduction plan, not instead of it. If you're not sure where to start, our Impact Funds offer a ready-made way to contribute to climate solutions both in the UK and around the world.

What makes a high-quality carbon project?

At Ecologi, we don’t just buy any credit on the market. Our in-house team assesses hundreds of carbon projects each month, using a rigorous internal rubric called the Carbon Project Assessment Framework (CPAF).

This framework helps us identify projects with the greatest real-world impact, by evaluating them across three pillars:

Climate: emissions reduced or removed with measurable impact

Nature: biodiversity and ecosystem protection

People: benefits for local communities and livelihoods

All projects undergo strict due diligence and are independently verified.

Only projects that meet our quality thresholds make it through. Many of the credits we fund are also rated by third-party analysts like Sylvera, Calyx Global, and Renoster, giving our business customers an added layer of confidence.

Reframing carbon offsetting in a way that makes a real difference

Buying carbon credits isn’t a pass to keep emitting, and it’s not the same thing as climate leadership.

If your business is aiming for net-zero, the SBTi says you’ll eventually need to neutralise your residual emissions with carbon removal credits - after you’ve reduced your emissions as much as possible. Even then, those removals should account for no more than 10% of your original footprint.

These removals are expensive, and not a substitute for reductions. That’s why relying solely on offsetting, even with carbon removals, won’t get us where we need to go.

It’s time to reframe how we think about climate finance. Rather than “offsetting” to cancel out your footprint, think of it as funding climate action. It’s not a loophole. It’s just one part of running a responsible business, alongside your reduction efforts.

Work with Ecologi to take credible climate action

Rethinking carbon offsetting is essential if your business wants to lead on climate action, avoid greenwashing risk, and stay ahead of stakeholder expectations.

At Ecologi, we help businesses build future-proof strategies: from measuring emissions and setting science-based targets, to designing Oxford-aligned carbon credit portfolios and funding only the highest-quality projects.

You’ll get access to independently assessed credits, transparent reporting, and expert support to align your strategy with the latest guidance from the SBTi, Oxford Principles, and beyond.

If you’re ready to move beyond offsetting and take credible climate action that reduces emissions, restores nature, and demonstrates real progress, speak to our experts today.